Download a free mileage reimbursement and tracking log for Microsoft Excel® Whether you're an employee or a business owner, it's important to keep good business mileage records so that you have the information you need for either completing your company's mileage reimbursement form or for determining the mileage deduction on your tax return. Vertex42's Business Mileage Tracker will help you keep good records and determine total mileage for reimbursement or deduction.

Keep reading below the download block to learn more about how to keep track of your business mileage. Employees are normally required by employers to keep accurate records for reimbursements. Use the Vertex42's Mileage Tracker to keep track of your business mileage, purpose, and notes. The template will also help you to calculate the amount you are owed. If your company has a specific reimbursement form for you to use, then keep a copy of Vertex42's Mileage Tracking Log in your car to track mileage at the source. The Mileage Log is formatted for portability and can be easily kept in the car.

For Small Business Owners. Business owners have two options when it comes to deducting the car expenses. They can choose from the Standard Mileage deduction method or the Actual Car Expenses deduction method.

You should read the appropriate IRS publication about this, because there are certain requirements and qualifications associated with each of these methods. Regardless, both methods require accurate records be kept as evidence for the deductions. Under the Standard Mileage deduction, the miles are multiplied by the IRS deduction rate to determine the amount of the deductions. Actual expenses for things like gas, insurance and maintenance are not deducted, because they are factored into the mileage reimbursement rate. Use Vertex42's Mileage Tracker to track the miles. The total deduction is then simply the mileage rate multiplied by the reimbursable miles. The Actual Expenses deduction is used for 'itemizing' the actual cost of owning, maintaining and using the vehicle for business purposes.

If the vehicle is owned and used 100% for business, then all of these costs can be deducted (see the IRS publication for more information about what costs can be deducted). In cases where the business use is less than 100%, only a percentage of the total expenses can be deducted. Vertex42's Mileage Tracker was designed to track the business miles and the total miles so that you can calculate the '% Business Use.' For Charity and Non Reimbursed Business Use. There are several situations where you may be able to deduct mileage from your personal taxes, including charity volunteer work, moving, medical travel and unreimbursed business use. In all of these cases, accurate records of your mileage are required. Make sure you review the IRS specifics for each of these cases or consult a tax accountant before taking these deductions.

Tips for Mileage Tracking • Seek the help of tax professionals for complicated or questionable situations. Better to be safe than sorry. • Be careful not to mix the Standard Deduction and Actual Expense methods. For example, if you reimburse at the standard rate, don't deduct the actual cost of the gas or service fees. • Mileage for commuting to and from work is not deductible. Don't even go there. • Include specifics in your notes about your trips for future reference.

This could be important in an audit situation. Include the purpose, start and end locations, people visited and outcomes.

Note other costs such as parking and tolls. • Be aware that there are rules on switching between the Standard Mileage and Actual Cost deduction methods. • If you are an employee, make sure you understand what you can and cannot deduct from your taxes. If you are reimbursed under an accountability plan (your reimbursements are NOT on your W-2), then you are not allowed to deduct the mileage.

If your reimbursements do show in your W-2, then you may be able to deduct your mileage as long as you follow the rules and limitations. • If you fail to record actual mileage, then make an educated guess backed up with additional information. For example, determine the mileage using a web based mapping system and print a copy for your records.

Resources for Mileage Tracking and Reimbursement • at irs.gov - This is the official IRS publication on tax deductions for business use of vehicles. It outlines the two different methods available for deductions – standard mileage deduction and the actual expenses deduction. It provides specifics about when to use each method as well as information for employees who are reimbursed for their mileage. • at irs.gov - This page lists the mileage rates for business, medical, moving and charity reimbursement rates. Make sure to look up the latest rates for the current year. • at seriousgivers.org - This site provides details and information about deductions for charity volunteers.

Provides details on the rate, what qualifies and other options that you may have. • at irs.gov - This IRS document shows the rates over the last 10 or so years. Interesting to see how it changes over time and it doesn't always go up. • - Track your auto maintenance costs using Vertex42's new maintenance log.

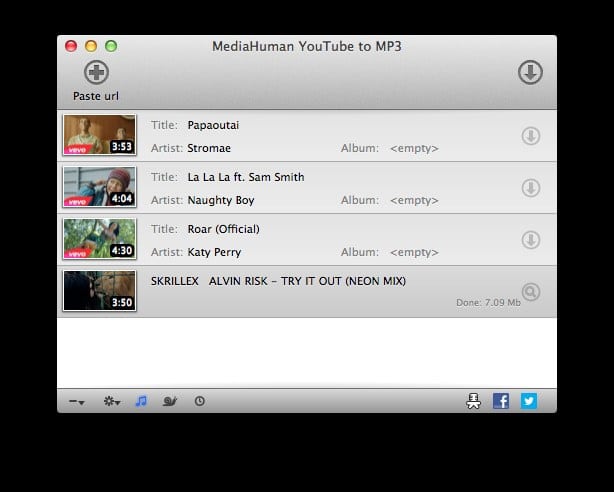

PDF to MP3 Software Informer. Featured PDF to MP3 free downloads and reviews. Latest updates on everything PDF to MP3 Software related. Do you want to convert a PDF file to a MP3 file? Don't download software - use Zamzar to convert it for free online. Click to convert your PDF file now. PDF To MP3 Converter Software v7 Free Download Latest Version for Windows. It is full offline installer standalone setup of PDF To MP3 Converter Software v7.